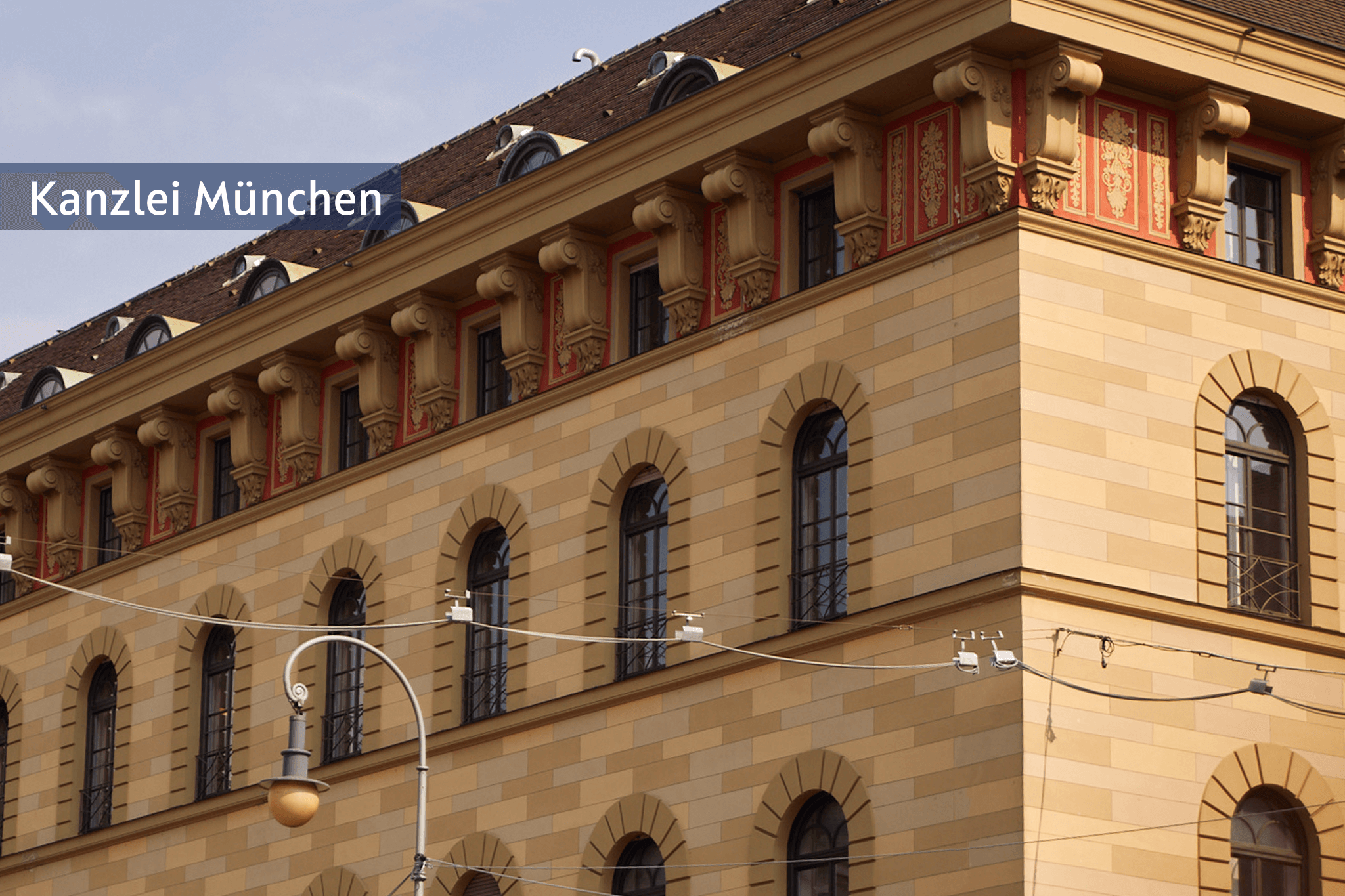

Rechtsanwälte und Fachanwälte für Erbrecht, Steuerrecht sowie Handels- und Gesellschaftsrecht – Experten in der Vermögens- und Unternehmensnachfolge in München, Berlin und Würzburg

SCHUHMANN Rechtsanwälte bieten vermögenden Privatpersonen, ihren Familien und Familienunternehmen das gesamte Leistungsspektrum der Private-Client-Beratung – von der Nachlassplanung und Vermögensstrukturierung, der Planung von Unternehmens- und Vermögensnachfolgen sowie der dauerhaften Beratung von Familienunternehmen, der Begleitung bei Unternehmensverkäufen, der Testamentsvollstreckung, der Nachlassabwicklung bis zur gerichtlichen Vertretung unserer Mandanten.

Als Rechtsanwälte sowie Fachanwälte für Erbrecht, Steuerrecht sowie Handels- und Gesellschaftsrecht zeigen wir Chancen und Risiken auf und schätzen Rechtspositionen realistisch ein.

Wir vertreten Sie gerichtlich, außergerichtlich und vor Behörden. Generationen von Unternehmern und Familien vertrauen uns ihre Werte an – darauf sind wir stolz. Unsere Anwälte erstellen steueroptimierte Testamente und Vermögenskonzepte. Auch bei Pflichtteilsansprüchen oder streitigen Erbengemeinschaften sind wir Ihre kompetenten Ansprechpartner. Im Erbfall übernehmen wir die gerichtliche sowie außergerichtliche Vertretung bei vermögensrechtlichen Streitigkeiten und beraten Sie bei der Vermögensdisposition sowie der Gestaltung der Erbschaftsteuer. Unsere Lösungen sind rechtssicher, durchsetzungsstark, wirtschaftlich, zukunftsorientiert und streitvermeidend.

Kompetenz

& Vertrauen

Seit vielen Jahren vertrauen unserer ausgezeichneten Kompetenz in allen erbrechtlichen sowie steuerrechtlichen und unternehmensrechtlichen Fragen:

- vermögende Privatpersonen

- Familienunternehmer

- Family Offices

- Banken

- Testamentsvollstecker

- Vermögensverwalter und Berater

Das Team SCHUHMANN Rechtsanwälte

Rechtsanwälte, Steuerberater und Patentanwältin

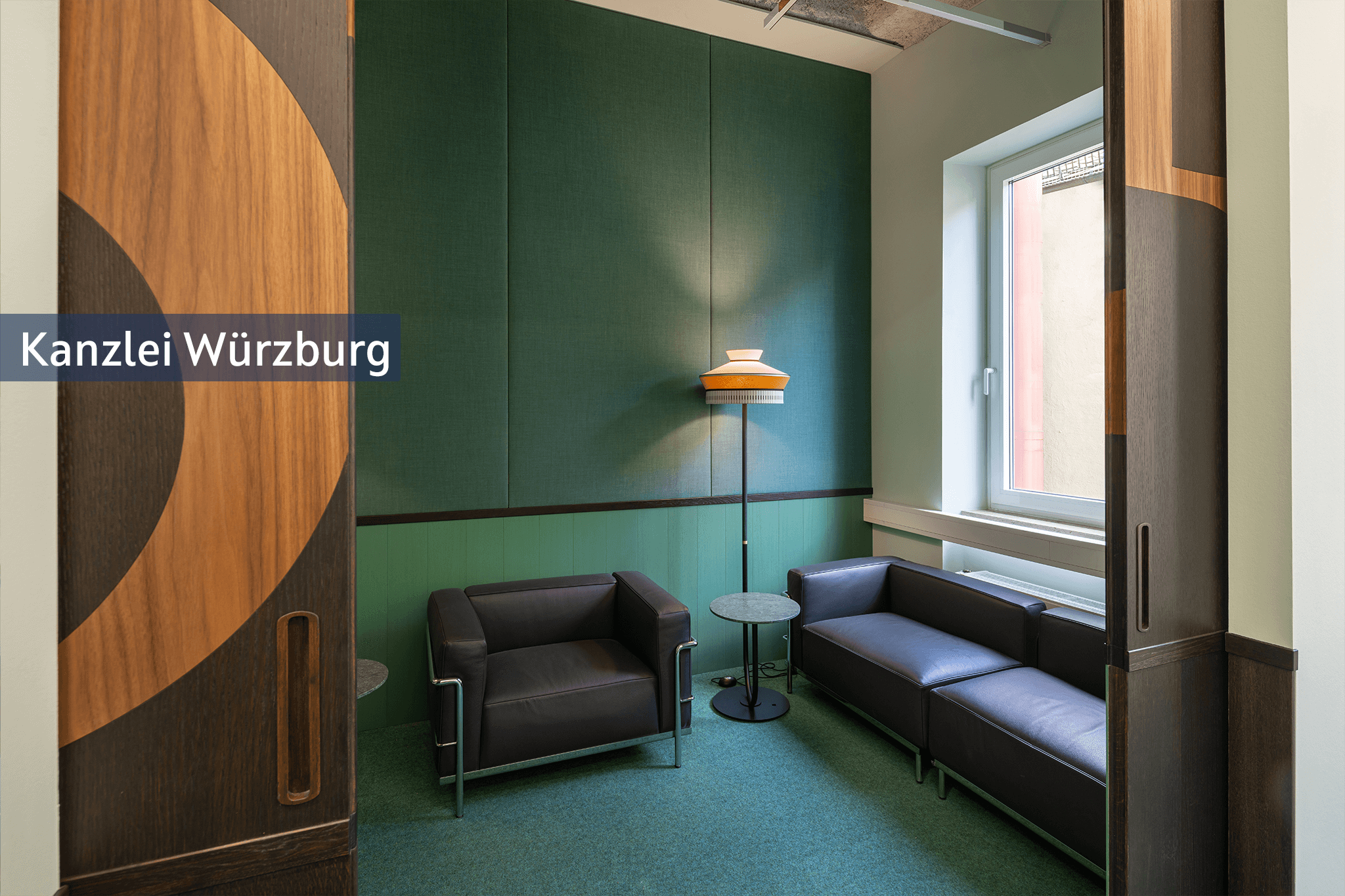

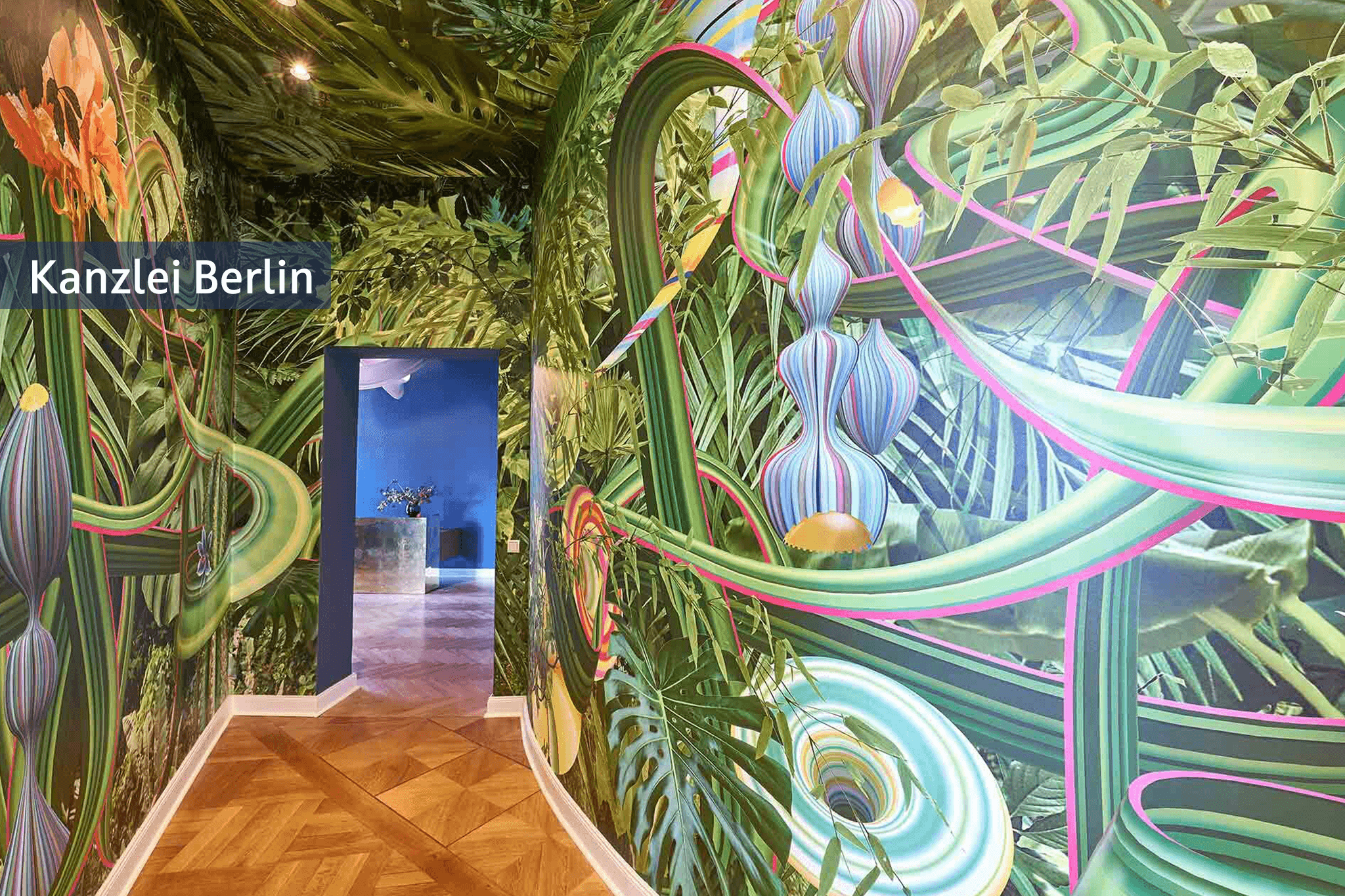

Unsere Rechtsanwälte und Steuerberater aus München, Berlin und Würzburg haben sich konsequent auf die Gebiete Erbrecht, Steuerrecht sowie Vermögensnachfolge und Unternehmensübergabe spezialisiert. Die SCHUHMANN Rechtsanwaltsgesellschaft mbH mit Sitz in München, Berlin und Würzburg zählt zu den führenden Rechtsanwaltskanzleien mit Schwerpunkt Erbrecht in Deutschland.

Geschäftsführung

Seit vielen Jahren leiten und entwickeln Dr. Markus Schuhmann, Dr. Isabella Schuhmann und Doris Huber die Kanzlei Schuhmann Rechtsanwälte in München, Berlin und Würzburg mit Leidenschaft und großem Erfolg.

Unser Office-Team

Unser Team sorgt für eine reibungslose Projektkoordination und ist für Sie als Ansprechpartner in allen organisatorischen Fragen täglich zwischen 8:30 Uhr und 20:00 Uhr erreichbar.

Persönliche Beratung

- Sie planen die Nachfolge Ihres Privat- oder Unternehmensvermögens?

- Sie sind Erbe, Vermächtnisnehmer oder Pflichtteilsberechtigter?

- Sie möchten Ihr Vermögen strukturieren oder schützen?

- Sie planen eine Investition oder Vermögensdisposition?

- Sie haben Probleme im Familien- oder Gesellschafterkreis?

- Sie benütigen Unterstützung bei der gerichtlichen Durchsetzung Ihrer Ansprüche?

persönliche Beratung anfordern